The Senate’s upcoming investigation into the role of e-wallets in facilitating online gambling could pose new challenges for GCash as it prepares for a highly anticipated initial public offering (IPO).

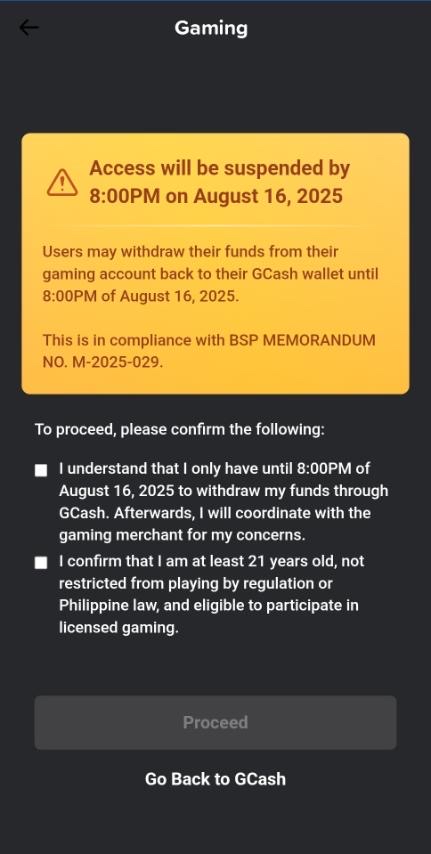

Lawmakers have signaled they will summon GCash and rival Maya to the next hearing of the Senate Committee on Games and Amusement, chaired by Sen. Erwin Tulfo, to explain how their platforms are used for deposits and withdrawals on gambling sites. The inquiry follows evidence presented by Sen. Win Gatchalian showing that illegal operators continue to accept transactions via e-wallets despite a Bangko Sentral ng Pilipinas (BSP) order to remove in-app gambling links within 48 hours.

Senators say the probe will focus not only on compliance but also on the social costs of online gambling including addiction, family breakdowns, and financial distress and whether the integration of gambling with e-wallet services has accelerated these harms.

Market analysts warn that the investigation could inject regulatory risk into GCash’s IPO pitch. “Even if gambling-related flows represent a small fraction of total transactions, the political optics and policy uncertainty can influence both valuation and timing,” one investment banker said.

Potential risks include tighter rules on e-wallet payment links, added compliance costs, and reputational concerns among ESG-conscious investors. While GCash’s parent company Globe Telecom has not commented on the Senate proceedings, industry observers say any delays or negative headlines could weigh on IPO momentum.

The Senate is expected to press e-wallet executives for concrete measures to block gambling transactions and strengthen Know-Your-Customer protocols. BSP officials have said cutting off payment links entirely would require new legislation which is a step some senators appear ready to consider.